How Anne made $14,000 from a $1,000 car

When Anne and her husband's third child arrived it was time to upgrade to a bigger car. Then came the question: what to do with the $1,000 Mazda they'd been using until then?

When Anne bought her 2001 Mazda 121 from her grandparents several years ago, she paid just $1,000. It served her family well for many years, but when their third child arrived it was time to upgrade to something bigger.

“We were trying to figure out what to do with the Mazda, because we really didn’t need two cars. We were tossing up about keeping it or selling it.”

When someone suggested they could try renting it out on Uber Carshare, Anne was intrigued. She’d heard of Uber Carshare from her brother and his family, who borrow cars when they need something bigger than their bikes.

Anne decided it was worth giving it a go. Three years since joining Uber Carshare, Anne’s little car has made nearly $14,000.

“It’s been an excellent decision,” says Anne. “The car’s income well and truly pays for the upkeep of the car, plus some extra to add to our household budget. We wouldn’t have got that much if we’d sold it.”

Anne’s Mazda busts two of the biggest myths many car owners have about the highest-earning types of cars: that only newer cars can make much money and that the higher you put your rates, the more money you’ll earn.

The age myth

People often think that the newer a car is, the more it will earn. It seems like common sense: newer cars are more expensive to buy and surely Borrowers would prefer a new car to an old one.

Anne’s car (and our data) tell a different story.

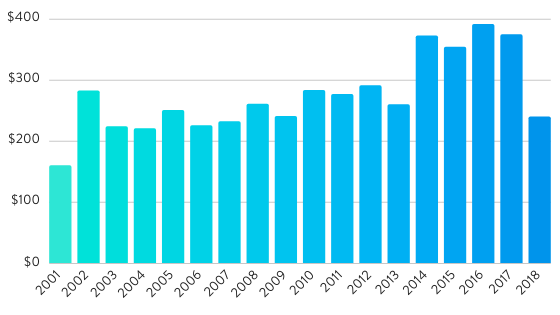

Average monthly income by year of manufacture - small, medium and large cars

Average monthly income by year of manufacture - small, medium and large cars

For most trips, Uber Carshare Borrowers aren’t looking for the newest model car with all the mod cons. As long as the car is reliable, relatively clean and comfortable to drive, they’re more likely to choose one that’s closer to home or priced competitively. Very new cars earn well, but there’s little difference in income between a car that’s five years old and one that’s 18 years old. An older, well-maintained car great to rent out.

Learn more about renting out your car

The rates myth

This is another assumption that makes sense on face value: if you charge more for your car, you’ll earn more each month.

When an Owner is wanting to boost their income, we often recommend they experiment with dropping their rates a little bit. It might sound counter-intuitive, but dropping your rates can actually see your car get more bookings, so that you end up taking home more money each month. Even though you earn a little less per hour or day, you’re likely to have more days booked so that overall you end up ahead.

This has definitely been the case for Anne’s car, which costs just $5 an hour or $20 a day plus 33 cents per kilometre.

“It’s an old car, it’s a bit beaten up and it doesn’t have any mod cons, but it still goes well and it’s a nice car to drive around the city. I think I would feel a bit fraudulent charging too much. I’m happy to charge $5 an hour; that seems reasonable for what Borrowers are getting. If they don’t feel like they’ve shelled out too much, I hope they’ll be forgiving of its quirks,” she said.

Not only do Anne’s low rates help set her Borrowers’ expectations, they’re also a big factor in how much her car has been able to earn.

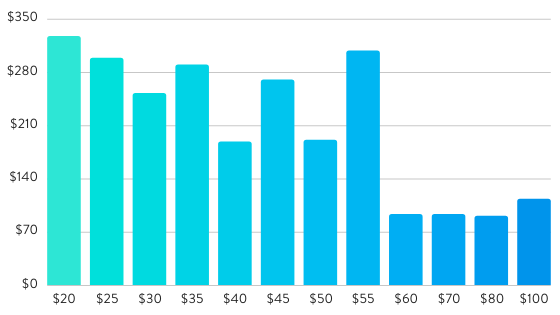

This data on earnings shows that the key to a high-earning car might just be a lower daily rate.

Average monthly earnings by daily rate - small, medium and large cars

Average monthly earnings by daily rate - small, medium and large cars

Many Uber Carshare Borrowers are price sensitive. One of the most common reasons Borrowers give for not owning a car is to avoid the costs of ownership. Borrowers are a financially savvy bunch, and while they might splash out for a special occasion, for most trips they’re looking for the best deal.

If your car is competitively priced, you might just find it’s one of the most popular and highest-earning cars in your neighbourhood.

The final piece of the puzzle: availability

Anne’s car has one final thing going for it: it’s available nearly all the time.

“We use the car very rarely. My husband cycles or gets the tram to work and I either take our other car or cycle. There’s been the odd occasion we’ve needed two cars, but mostly we don’t use it. I think having it available a lot of the time has really worked in our favour.”

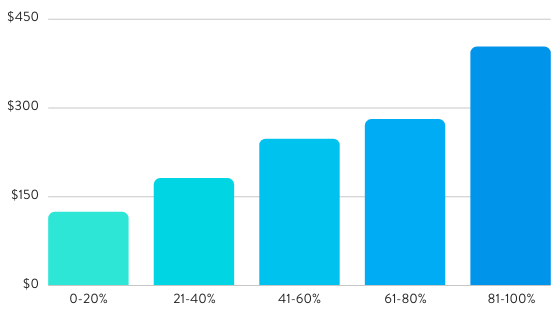

Once again, the data backs this up. In fact, availability is the number one factor impacting a car’s income. The more available a car is, the more it will earn.

Average monthly earnings by availability - small, medium and large cars

Average monthly earnings by availability - small, medium and large cars

Got a car you don't use much?

Learn more about renting out your car

Want to get your car working harder?

As our data shows, there are two simple things you can get started with right now to get your car working harder for you:

- Set you rates competitively - check our recommended pricing and the rates of cars near you and consider dropping your rates a little to be more attractive to Borrowers

- Availability - if you have blockouts on your car that you don’t always need, remove them to create more availability for Borrower bookings

Our Help Centre has plenty more resources to help you get the most out of sharing your car, including the option to book a call with our Owner Experience team to get personalised tips to boost your car’s income.

The data in this article is for small, medium and large cars that have been listed on Uber Carshare for at least 6 months, with at least 50% average availability.